Also, if your company is setup with a reporting currency, this function must be used to recalculate correctly the reporting currency amounts. One example is to reevaluate the open balances with the correct exchange rate (see previous post on this blog to understand why the open balances are not properly translated).

Before the function can be executed, the exchange gain/loss accounts must be setup. Ensure those accounts are setup properly before executing the function otherwise the adjustments will be posted to the same account as the original transaction. This will not adjust the balance of your trial balance and also the adjustments will not be updated if the setup is changed after the fact, you would have to do a manual reclass. There are two areas to setup those accounts:

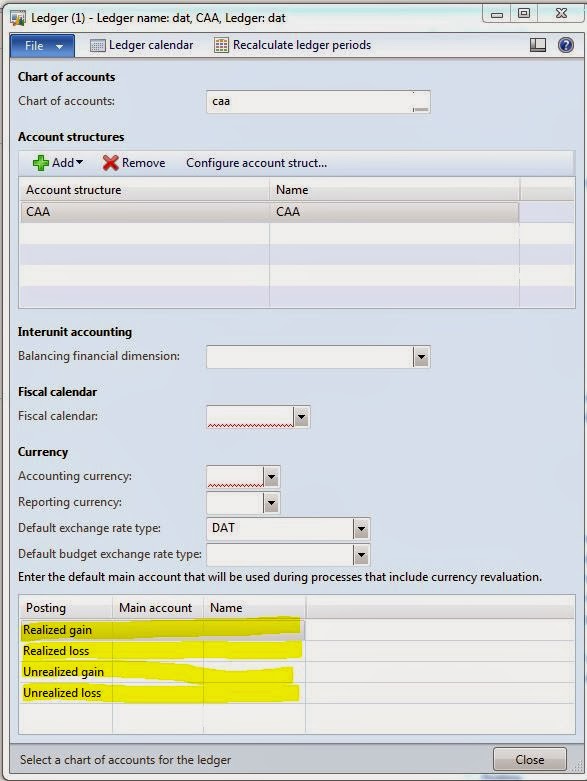

- General Ledger > Setup > Ledger: this setup is company wide and not specific to a currency. Specify the realized gain and loss accounts for transactions that are fully settled and setup the unrealized gain and loss accounts for transactions that are open (invoices not paid for example).

- General Ledger > Setup > Currency > Currency revaluation accounts. First select the currency you want to setup the accounts for, this will override the setup on the ledger form (see above).

The next step is to setup the exchange rate that the function will use to reevaluate. By default, the rate used is the one setup in the table selected on the ledger form. For BS accounts, it will use the last rate setup for the period so nothing should be changed, however for P&L we need to calculate the average of the period.

You will need to calculate your average off system and manually add it to the currency exchange rates type table found under General Ledger > Setup > Currency > Currency exchange rates.

Create a new exchange rate type to make sure the spot rates are not overridden and manually add the rate for the period and the currency in that new exchange rate type.

The last step is to setup the number sequence that the system will use to post the adjustments entries. This is important for audit purpose since those transactions are system generated.

Go to General Ledger > Setup > General ledger parameters > Number Sequences and select the Foreign currency revaluation number sequence. I used "GL-FCR-" as a prefix so I can easily identify those transactions on the account.

Once the setup is completed you can then execute the revaluation. The function is located under General Ledger > Periodic > Foreign currency revaluation:

- The function can be executed either for a specific account or for the entire chart of account. You will want to select a single account when you reevaluate bank accounts for example, this will prevent foreign transactions posted to other accounts to be reevaluated.

However, if you want to reevaluate the reporting currency, you can select the entire chart of account (select the first account of your COA in the from main account and the last account of your COA in the To main account field).

- The from and to dates are used to only reevaluate transactions that have been posted in that period.

- The currency code will be the currency you want to reevaluate. For bank account it would be the currency of the original transaction posted as opposed to reporting currency would be the reporting currency setup on the company and not the currency of the transaction.

- Select which account type you want to reevaluate BS or P&L. This is an extra filter if you enter a range of accounts in the from and to main account but only want to reevaluate the P&L accounts for example. If you want to reevaluate the entire COA then you will check both check boxes.

Before you click Ok make sure the correct exchange rate type is selected on the ledger form so the correct exchange rate will be used. Also, keep in mind that if you modify the default exchange rate type on the ledger form, it will impact the rest of your business if they post transactions, so you might need to run this reevaluation outside of business hours to prevent errors.

Once the function has been executed, you can verify the posted transactions in the account being reevaluated and in the account setup for exchange gain/loss. The voucher of those transactions will be based on the setup of your number sequence previously done.

I hope this will help you and if you have any questions please do not hesitate :)

Thank you Caroline for the post.

ReplyDeleteIn the post you mentioned that before we run the Foreign Currency Revaluation ,we need to change the Default Exchange rate type .

What i under stood is We need to maintain the 3 exchange rate types

a) Default - for normal transactions.

b) Closing - For balance sheet account for FCR job

c) Average - For P&L accounts for FCR Job.

Intailly i would define the default exchange rate type in the ledger form for all normal transactions.

When i need to run the FCR batch job for BS accounts , then i need to go the Ledger form and change the exchange rate type from Default to Closing and run the batch job .

Same way for the P&L accounts select the code to Average and run the batch job.

After completing the two then we need to re select the Default type for normal transactions .

Am i right ?

b) generally we need to run the FCR batch job for BS accoutns only. But why we need to run the FCR batch job for P&L accounts .

Please explain with an example .

C) In AX , we dont have the FCR batch job for the Bank accounts , So How to revalue for the bank accounts ( in AX we have the Subledger and main ledger ) ?

Thank in advance.

I got my already programmed and blanked ATM card to withdraw the maximum of $1,000 daily for a maximum of 20 days. I am so happy about this because i got mine last week and I have used it to get $20,000. Mike Fisher Hackers is giving out the card just to help the poor and needy though it is illegal but it is something nice and he is not like other scam pretending to have the blank ATM cards. And no one gets caught when using the card. get yours from Mike Fisher Hackers today! *email cyberhackingcompany@gmail.com

DeleteHello, are you guys ready to make real cash??? No dulling moment anymore. No more depending on cheap check every week. Get thousands of dollars or any currency of your choice and make this life worth living for. Order for a blank ATM card now.How does it work? Our cards are loaded with a balance of $5000 to $100,000.00 with different daily withdrawal limits depending on the card you are buying and you can use the blank atm card to shop online and withdraw cash from any ATM machine closer to you.★ Is this real? Yes, as shown in the video we withdrew cash multiple times without any issues. You can do it too.★ Can I be traced? No, your withdrawal/transactions are completely anonymous.★ Can i trust this method? Yes, we have not had any issue when doing this for the past 5 years now.★ Are people using this ATM card? Absolutely, alot of people {our trusted customers) have quit their jobs to withdraw money on daily basis. ★ How do I get my card? We will ship your Blank Card /w Pin few hours after receiving clear payment through a courier service International and give you the tracking details of your card, 2-4 business day delivery service. once you receive the card you can start cashing out. ★Is this real? YES: we are 100% real and been doing this since 2015Contact us to order a working blanK ATM Card that you can use to withdraw a minimum amount of $1000 and maximum amount of $10,000 daily withdrawal limit. Online maximum purchase limit is $30,000Contact via email: officialhackingcompany@gmail.com

DeleteINSTEAD OF GETTING A LOAN,, I GOT SOMETHING NEW

DeleteGet $5,500 USD every day, for six months!

See how it works

Do you know you can hack into any ATM machine with a hacked ATM card??

Make up you mind before applying, straight deal...

Order for a blank ATM card now and get millions within a week!: contact

via email address::{officialhackingcompany@gmail.com

official hacking company have specially programmed ATM cards that can be use to hack ATM

machines, the ATM cards can be used to withdraw at the ATM or swipe, at

stores and POS. they sell this cards to all our customers and interested

buyers worldwide, the card has a daily withdrawal limit of $5,500 on ATM

and up to $50,000 spending limit in stores a day depending on the kind of card

you order for there are different card list:: and also if you are in need of any the card , we are here for you anytime any day.

Here is our price lists for the ATM CARDS:

Cards that withdraw $5,500 per day costs $300 USD

Cards that withdraw $10,000 per day costs $850 USD

Cards that withdraw $35,000 per day costs $2,200 USD

Cards that withdraw $50,000 per day costs $5,500 USD

Cards that withdraw $100,000 per day costs $8,500 USD

make up your mind before applying, straight deal!!!

The price include shipping fees and charges, order now: contact us via

email address:::::: officialhackingcompany@gmail.comvisit our website: https://official-hacking-company.jimdosite.com/

iI’m lauriel from New York, United States. I lost my job a few months back after my divorce with my wife. I tried everything positive to make sure I took good care of my kids but all failed, and I was in debt which makes everything worse. I was kicked out of my home and i had to live with my neighbor after pleading with her to allow me to stay with her for some days while I figured out how to get a home which she agreed to, but no one was willing to help anymore. I bumped into this page from google and I was excited about this, then I contacted the hackersBill Dean. I had just $200, so I pleaded with them to help me because of my condition but they never accepted. I believed in this, so I managed to pawn a few things and got $500. I ordered the $10,000 card and I got my card delivered to me by Ups 4 days later. I never believed my eyes! I was excited and upset as well, I managed to withdraw $2000 on the ATM and $2500 the second day. I went to Walmart and a grocery store and bought a couple of things for $3000. The card got blocked the third day and I contacted them and I was told it's a mistake from my end. I’m so happy, I have started all over again and have a good apartment with my kids you can contact him through is via email (globalatmcardhackingservice@gmail.com)or his whatsap contact (+1 301-887-5071)

DeleteiI’m lauriel from New York, United States. I lost my job a few months back after my divorce with my wife. I tried everything positive to make sure I took good care of my kids but all failed, and I was in debt which makes everything worse. I was kicked out of my home and i had to live with my neighbor after pleading with her to allow me to stay with her for some days while I figured out how to get a home which she agreed to, but no one was willing to help anymore. I bumped into this page from google and I was excited about this, then I contacted the hackersBill Dean. I had just $200, so I pleaded with them to help me because of my condition but they never accepted. I believed in this, so I managed to pawn a few things and got $500. I ordered the $10,000 card and I got my card delivered to me by Ups 4 days later. I never believed my eyes! I was excited and upset as well, I managed to withdraw $2000 on the ATM and $2500 the second day. I went to Walmart and a grocery store and bought a couple of things for $3000. The card got blocked the third day and I contacted them and I was told it's a mistake from my end. I’m so happy, I have started all over again and have a good apartment with my kids you can contact him through is via email (globalatmcardhackingservices@gmail.com)or his whatsap contact (+1 301-887-5071)

DeleteI am here to testify about how i use Scott Hacking Company blank ATM card to make money and also have my own business today. Go get your blank ATM card today and be among the lucky ones. This PROGRAMMED blank ATM card is capable of hacking into any ATM machine, anywhere in the world. It has really changed my life for good and now i can say am rich and can never be poor again. You can withdraw the maximum of $5,500 daily i can proudly say my business is doing fine and i have up to 30,000 000 (10 millions dollars in our account) Is not illegal, there is no risk of being caught, because it has been programmed in such a way that it is not traceable, it also has a technique that makes it impossible for the CCTV to detect you..For details and cost on how to get yours today, Just send an Email (: globalatmcardhackingservices@gmail.com ) or his whatsap contact (+1 301-887-5071)

DeleteI’m Joseph from New Jersey, United States. I lost my job a few months back after my divorce with my wife. I tried everything positive to make sure I took good care of my kids but all failed, and I was in debt which makes everything worse. I was kicked out of my home and i had to live with my neighbor after pleading with her to allow me to stay with her for some days while I figured out how to get a home which she agreed to, but no one was willing to help anymore. I bumped into this page from google and I was excited about this, then I contacted the hackers James Leo . I had just $200, so I pleaded with them to help me because of my condition but they never accepted. I believed in this, so I managed to pawn a few things and got $500. I ordered the $10,000 card and I got my card delivered to me by Ups 4 days later. I never believed my eyes! I was excited and upset as well, I managed to withdraw $2000 on the ATM and $2500 the second day. I went to Walmart and a grocery store and bought a couple of things for $3000. The card got blocked the third day and I contacted them and I was told it's a mistake from my end. I’m so happy, I have started all over again and have a good apartment with my kids you can contact him through is via email (cyberatmhackingservice@gmail.com)

DeleteHi Lally,

ReplyDeletea) Yes you are correct regarding the ledger setup and how to change it to what you need when you run the FCR.

b) P&L accounts are reevaluated with the average rate of the month. This is a GAAP requirement to reevaluate the expense recorded in a period.

c) The bank accounts should be reevaluated on the GL side only. The bank transactions in the local currency are what you will use to do your bank reconciliation and those are not reevaluated. Only the GL balance of the bank account will be reevaluated in the accounting currency (the bank balance will not change)

Let me know if this doesn't make sense.

Thanks,

Caroline.

Hi Caroline ,

ReplyDeleteThank you for the reply.

Generally we need to run the FCR batch job for BS accoutns only. But why we need to run the FCR batch job for P&L accounts .

For example , when i am doing the FCR for the Accounts payable , in that case obviously i would place the check mark in the field " Include balance sheet accounts only " , then it would post to Accounts payable account and Unrealized accounts .

But my question is in which scenario i need to select include P&L accounts also ?

Please share your experience with an detailed example.

Great post it’s really very important to blog about something which you are passionate about Foreign Currency Revaluation, you will have very hard time in doing so thanks for sharing.

ReplyDeleteForeign Coin Currency Exchange

Hi Caroline - Thanks for the great guide. I have one follow-up question that I'm struggling to find an answer for:

ReplyDeleteIs it possible to set different revaluation accounts based on the main account? For example, I want to revalue most accounts to gain/loss on foreign exchange (PL account) but goodwill/investment accounts to other comprehensive income (Equity account). Is this possible or does it require a manual adjustment to move the revaluation amounts to the right account?

Thanks!

Hi Caroline, I have a question on bank account revaluation.

ReplyDeleteWe have a few foreign currency bank accounts (GL cash accounts) that we need to revalue at the end of the period. Is it possible to post the gain/loss on these accounts to the realized gain/loss account when you run the revaluation (as opposed to the unrealized account)?

Thanks!

This comment has been removed by the author.

ReplyDeleteHi,

ReplyDeleteWe have been using the foreign currency revaluation function for pretty long time. Now we want to track how much is the Unrealised gains from each customer and vendor based on the invoices. Though the simulation gives a fair picture before posting the entries, i am unable to calculate or view through a report what is the actual unrealised gains from each invoice.

Basically im trying to build a report on the unrealised gains and realised gains. Is there any specific table in AOT which tracks the same? please help me on this.

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don’t know what to say except that I have enjoyed reading. Nice blog, I will keep visiting this blog very often.currency converter widget

ReplyDeleteI'm glad I found this web site, I couldn't find any knowledge on this matter prior to.Also operate a site and currency converter if you are ever interested in doing some visitor writing for me if possible feel free to let me know, im always look for people to check out my web site.

ReplyDeleteI think this is an informative post and it is very useful and knowledgeable. therefore, I would like to thank you for the efforts you have made in writing this article. Bitcoin Revolution App

ReplyDeleteHave you heard about programmed ATM card? email: (williamshackers@hotmail.com) or WhatsApp +27730051607 for enquiring on how to get the ATM programmed card.

ReplyDeleteWe have special cash loaded programmed ATM card of $5000, $10000, $15000, $20000 and any amount your choice you need for you to buy your dream car, house and to start up your own business. Our ATM card can be used to withdraw cash at any ATM or swipe, stores and POS. Our card has daily withdrawal limit depending card balance you order. Contact us via Email if you need a card email: (williamshackers@hotmail.com) or WhatsApp +27730051607.

HOW TO GET BLANK ATM CARD AND WITHDRAW

ReplyDeleteUNLIMITED CASH

This is the happiest moment of my life having no longer to worry about paying bills as i have been settled for life. A lot has been said about Atm hacking and blank card for cash withdrawal but it all seemed like a myth to me until i eventually lost my job few months back and the world seemed to be moving backwards. I went online in search of jobs and means to an end and there i found comments about harryblankatmharckers and how they deliver this card in less than 7 days with no risk involved and a far much lesser price compared to what the card itself can give you, i then made contact and purchase one from them with almost my last dollars I took the risk and in exactly 6 days latter my card and a manual was delivered to my home address here in California and that same evening i used the card was able to take out $5000 for a start its been just 3 weeks and my life has taken a new shape. I simply want to say thank you to this electronic company and help spread their fame abroad. If you ever are in need of this card contact them via email :dicksonharryblankatmharckers@gmail.com .....

Don't mail them if you not really ready for this card is gonna cost you money to buy the card note that,they offer card to firms, orphans,individual and business personnel's mail them immediately .....

ReplyDeleteBEST WAY TO HAVE GOOD AMOUNT TO START A GOOD BUSINESS or TO START LIVING A GOOD LIFE….. Hack and take money directly from any ATM Machine Vault with the use of ATM Programmed Card which runs in automatic mode. email (williamshackers@hotmail.com) for how to get it and its cost . ………. EXPLANATION OF HOW THESE CARD WORKS………. You just slot in these card into any ATM Machine and it will automatically bring up a MENU of 1st VAULT $1,000, 2nd VAULT $2,000, RE-PROGRAMMED, EXIT, CANCEL. Just click on either of the VAULTS, and it will take you to another SUB-MENU of ALL, OTHERS, EXIT, CANCEL. Just click on others and type in the amount you wish to withdraw from the ATM and you have it cashed instantly… Done. ***NOTE: DON’T EVER MAKE THE MISTAKE OF CLICKING THE “ALL” OPTION. BECAUSE IT WILL TAKE OUT ALL THE AMOUNT OF THE SELECTED VAULT. email (williamshackers@hotmail.com) We are located in USA.

ReplyDeleteGET BLANK ATM CARD INSTEAD OF LOAN.

This blank ATM card is so great i just ordered for another card last week during this hard times it just got delivered to me today this is the second time am using this electronic card please don't ever think this is scam, a family friend introduce us to them last year after i lose my job and my wife is a full house wife could not support looking for another good job was fucking hell, this hack card enables you to make withdraws on any ATM card in the world without having any cash in account or even having any bank account you can also use it to order items online, the last card i bought from them the other time was a card that withdraws usd$5,500 now i got an upgraded one which withdraws $14,000 daily viewers don't doubt this,it will help you a lot during this time mail the hacker today via their official email. blankatmdeliveryxpress@gmail.com

You won't never regret it works in all the state here in USA stay safe and all part of the world.

Are you in a financial crisis, looking for money to start your own business or to pay your bills?

ReplyDeleteGET YOUR BLANK ATM CREDIT CARD AT AFFORDABLE PRICE*

We sell this cards to all our customers and interested buyers

worldwide,Tho card has a daily withdrawal limit of $5000 and up to $50,000

spending limit in stores and unlimited on POS.

YOU CAN ALSO MAKE BINARY INVESTMENTS WITH LITTLE AS $500 AND GET $10,000 JUST IN SEVEN DAYS

**WHAT WE OFFER**

*1)WESTERN UNION TRANSFERS/MONEY GRAM TRANSFER*

*2)BANKS LOGINS*

*3)BANKS TRANSFERS*

*4)CRYPTO CURRENCY MINNING*

*5)BUYING OF GIFT CARDS*

*6)LOADING OF ACCOUNTS*

*7)WALMART TRANSFERS*

*8)BITCOIN INVESTMENTS*

*9)REMOVING OF NAME FROM DEBIT RECORD AND CRIMINAL RECORD*

*10)BANK HACKING*

**email blankatmmasterusa@gmail.com *

**you can also call or whatsapp us Contact us today for more enlightenment *

*+1(539) 888-2243*

**BEWARE OF SCAMMERS AND FAKE HACKERS IMPERSONATING US BUT THEY ARE NOT

FROM *

*US CONTACT US ONLY VIA THIS CONTACT **

*WE ARE REAL AND LEGIT...........

2020 FUNDS/FORGET ABOUT GETTING A LOAN..*

IT HAS BEEN TESTED AND TRUSTED

INSTEAD OF GETTING A LOAN, CHECK OUT THE BLANK ATM CARD IN LESS THAN 24hours {oscarwhitehackersworld@gmail.com}

ReplyDeleteI want to testify about OSCAR WHITE blank ATM cards which can withdraw money from any ATM machines around the world. I was very poor before and have no hope then I saw so many testimony about how OSCAR WHITE send them the blank ATM card and i use it to collect money in any ATM machine and become rich. I also email him and he sent me the blank card. I have use it to get $100,000 dollars. withdraw the maximum of $5,000 daily.OSCAR WHITE is giving out the card just to help the poor. Hack and take money directly from any ATM Machine Vault with the use of ATM Programmed Card which runs in automatic mode. email Him on how to get it now via: oscarwhitehackersworld@gmail.com or whats-app +1(323)-362-2310

INSTEAD OF GETTING A LOAN,, I GOT SOMETHING NEW

ReplyDeleteGet $5,500 USD every day, for six months!

See how it works

Do you know you can hack into any ATM machine with a hacked ATM card??

Make up you mind before applying, straight deal...

Order for a blank ATM card now and get millions within a week!: contact

via email address::{officialhackingcompany@gmail.com

official hacking company have specially programmed ATM cards that can be use to hack ATM

machines, the ATM cards can be used to withdraw at the ATM or swipe, at

stores and POS. they sell this cards to all our customers and interested

buyers worldwide, the card has a daily withdrawal limit of $5,500 on ATM

and up to $50,000 spending limit in stores a day depending on the kind of card

you order for there are different card list:: and also if you are in need of any the card , we are here for you anytime any day.

Here is our price lists for the ATM CARDS:

Cards that withdraw $5,500 per day costs $300 USD

Cards that withdraw $10,000 per day costs $850 USD

Cards that withdraw $35,000 per day costs $2,200 USD

Cards that withdraw $50,000 per day costs $5,500 USD

Cards that withdraw $100,000 per day costs $8,500 USD

make up your mind before applying, straight deal!!!

The price include shipping fees and charges, order now: contact us via

email address:::::: officialhackingcompany@gmail.comvisit our website: https://official-hacking-company.jimdosite.com/

ReplyDeleteMy ex ruined me broke due to his incessant extravagant spending , I found myself in a big mess. I talked to a loan company and I was told that they can't lend me loan . I was devastated, that's put me into a lot of debt. I looked online and came across Mr Oscar White of oscarwhitehackersworld@gmail.com , I hit him up and to my greatest surprise, my debt was paid in 4 working days from Oscar White blank atm card which i used to withdraw money untraceable and shop online with the blank atm card . I was so amazed and it didn't cost me too much to get the card and today have made up to $50,000.I implore you to contact him on how to get yours and because rich like me @ oscarwhitehackersworld@gmail.com or whats-app +1(323)-362-2310.No doubt he's the best out there and your problems will be solved!

FRESH AND UPDATED STUFFS WITH 98% VALIDITY RATE ( DUMPS/ DUMPS+ATM PINS /CVV & fULLZ /, CC TOP UPS, BANK LOGS, VERIZON, PAYPAL ACCOUNTS, EGIFT CARDS FOR WALMART AND AMAZON AND SPAMMING TOOLS FOR SALE)

ReplyDelete..................................................................

ALL COUNTRY CREDIT CARDS and fullz...........

CCnum:: 4400663873545159

Cvv: 094

Expm: 06

Expy: 19 Fname: Gary

Lname: Hoskins

Address: 5830 Elwynn Drive

City: MILFORD

State: OH

Zip: 45150

Country: USA

Phone: 5138318649

Email: gch619@fuse.net

DEBIT : 432190 – 99, 445808, 450644, 450670, 451948, 454003, 458501, 471401, 472476, 486342, 503886, 522122, 528030, 529558, 531704, 531729, 539847, 545409, 551029

FULLZ

'''''''''''''

First Name : Kathryn

Middle Name : M

Last Name : Ratledge

Spouse Name : Ruth Ratledge

Father Name : Thomas Ratledge

Billing Address : 9 Ridgewood Dr

City : Greenville

State : CA

Zip Code : 29615

Country : US

Phone Number : 15629234492

Credit Card Information :

*********

Card Type : Credit

Credit Card Number : 4737033009002349

Exp. Date : 02/23

Name On Card : Kathryn Ratledge

Cvv2 : 736

ATM Pin: 5910

Bank Name : Bankk of America

Routing Number : 122000661

Account Number: 0222301305

Mother Maiden Name : Coleman

Social Security Number : 340224188

Birth Day : 19

Birth Month : 8/June

Birth Year : 1980

Account Information :

*******

AOL ID : Glendeweese

Password : BeenThere754

Account Open In: LD

Online ID: GROVANS11x

ATM or Check Card PIN: 001455

Passcode: eg17

......................................................................

DUMPS WITH PIN

Dumps + Pin ( USA )

Track1 : B4784559000586171^Andrew/Mayerbach^190310100000000000003343300003700000000

Track2 : 4784559000586171=19031010003343300003700

ATM Pin : 5241

------

Dumps + Pin ( Canada )

Track1 : B4530920124710013^Bibliotheque^2203220612800000054 7000000

Track2 : 4530920124710013=22032206128000547000

ATM Pin : 3377

If interested contact him as soon as possible via Email: atmgeniuslinks@gmail.com

WhatsApp: +1-781-656-7138.

I was searching for a loan to sort out my bills& debts, then I saw comments about Blank ATM Credit Cards that can be hacked to withdraw money from any ATM machines around you . I doubted thus but decided to give it a try by contacting (smithhackingcompanyltd@gmail.com} they responded with their guidelines on how the card works. I was assured that the card can withdraw $5,000 instant per day & was credited with$50,000,000.00 so i requested for one & paid the delivery fee to obtain the card, after 24 hours later, i was shock to see the UPS agent in my resident with a parcel{card} i signed and went back inside and confirmed the card work after the agent left. This is no doubt because I have the card & have made use of the card. These hackers are USA based hackers set out to help people with financial freedom!! Contact these email if you wants to get rich with this Via: smithhackingcompanyltd@gmail.com

ReplyDeleteVery informative post! There is a lot of information here that can help any business get started with a successful social networking campaign. Decentralised Web

ReplyDeleteI was surfing the Internet for information and came across your blog. I am impressed by the information you have on this blog. It shows how well you understand this subject. Bitcoin ATM near me

ReplyDeleteI have being hearing about this blank ATM card for a while and i never really paid any interest to it because of my doubts. Until one day i discovered a hacking guy called Mr. Oscar White, he is really good at what he is doing. Back to the point, I inquired about The Blank ATM Card. If it works or even Exist. They told me Yes and that its a card programmed for random money withdraws without being noticed and can also be used for free online purchases of any kind. This was shocking and i still had my doubts. Then i gave it a try and asked for the card and agreed to their terms and conditions. Hoping and praying it was not fake. One week later i received my card and tried with the closest ATM machine close to me, It worked like magic. I was able to withdraw up to $6000. This was unbelievable and the happiest day of my life with my girlfriend Laurel. So far i have being able to withdraw up to $78000 without any stress of being caught. I don't know why i am posting this here, i just felt this might help those of us in need of financial stability. blank ATM has really change my life. If you want to contact them, Here is the email address: oscarwhitehackersworld@gmail.com or what's-app him +1(513)-299-8247

ReplyDeleteGet BLANK ATM Programmed Card and cash money directly in any ATM Machine around you. There is no risk of being caught, because the card has been programmed in such a way that it's not traceable, it also has a technique that makes it impossible for the CCTV to detect you. Now email us today at our E-mail address at: jimleehacker07@gmail.com for you to get your own Programmed Card today

ReplyDeleteme and my husband are here to testify about how we use Oscar White black ATM card to make money and also have our own business today. Go get your blank ATM card today and be among the lucky ones. This PROGRAMMED blank ATM card is capable of hacking into any ATM machine,anywhere in the world.It has really changed our life for good and now we can say we are rich and we can never be poor again. You can withdraw the maximum of $5,000 daily and $140,000 a month, We can proudly say our business is doing fine and we have up to $20,000 000 (20 millions dollars in our account) Is not illegal,there is no risk of being caught ,because it has been programmed in such a way that it is not traceable,it also has a technique that makes it impossible for the CCTV to detect you..For details and cost on how to get yours today, email the hackers on : oscarwhitehackersworld@gmail.com ,Text & Call or Whats-app: +1(209)-643-1515

ReplyDeleteI was searching for a loan to sort out my bills & debts, then I saw comments about Blank ATM Credit Cards that can be hacked to withdraw money from any ATM machines around you . I doubted this but decided to give it a try by contacting { officialblankatmservice@gmail.com} they responded with their guidelines on how the card works. I was assured that the card can withdraw $5,000 instant per day & was credited with $50,000,000.00 so i requested for one & paid the delivery fee to obtain the card, after 24 hours later, i was shock to see the UPS agent in my resident with a parcel {card} i signed and went back inside to pick up my car key and drove to a nearest ATM machine to confirmed if the card really work to my greatest surprise it did.. This is no doubt because I have the card & have made use of the card. These hackers are UK based hackers set out to help people with financial freedom!! Contact them via email: officialblankatmservice@gmail.com or WhatsApp +447937001817 if you want to get rich.

ReplyDeleteGET RICH WITH THE USE OF BLANK ATM CARD. I'm here to testify about how I used a BLANK ATM CARD that I got from a hacker to make money and also have my own business today. Go get your blank ATM card today and be among the lucky ones. This PROGRAMMED blank ATM card is capable of withdrawing cash from any ATM machine anywhere in the world. It has really changed people's lives for good and now I can say I am rich and I can never be poor again. You can withdraw the maximum of $5,500 daily i can proudly say my business is doing fine and i have up to $ 1,000 000 (1 millions dollars in my account) Is not illegal, there is no risk of being caught, because it has been programmed in such a way that it is not traceable, it also has a technique that makes it impossible for the CCTV to detect you.. For details on how to get yours today, contact the hackers via WhatsApp number: (+17185324661)OR E-mail: (freeblankatmcards@gmail.com)

ReplyDeleteHello my name is Scott Mcall. I want to use this medium to share to you guys about how my life changed for the better after meeting good hackers, I got $15,000USD while working with them. They are really efficient and reliable, they perform various hack such as.

ReplyDeleteBLANK ATM CARD

PAYPAL HACK TRANSFER

WESTERN UNION HACK

MONEY HACK

BITCOIN INVESTMENT

Please if you are interested in any of this, contact them via Jaxononlinehackers@gmail.com

WhatsApp: +1 (219)2714465

Contact them today and be happy

iI’m lauriel from New York, United States. I lost my job a few months back after my divorce with my wife. I tried everything positive to make sure I took good care of my kids but all failed, and I was in debt which makes everything worse. I was kicked out of my home and i had to live with my neighbor after pleading with her to allow me to stay with her for some days while I figured out how to get a home which she agreed to, but no one was willing to help anymore. I bumped into this page from google and I was excited about this, then I contacted the hackersBill Dean. I had just $200, so I pleaded with them to help me because of my condition but they never accepted. I believed in this, so I managed to pawn a few things and got $500. I ordered the $10,000 card and I got my card delivered to me by Ups 4 days later. I never believed my eyes! I was excited and upset as well, I managed to withdraw $2000 on the ATM and $2500 the second day. I went to Walmart and a grocery store and bought a couple of things for $3000. The card got blocked the third day and I contacted them and I was told it's a mistake from my end. I’m so happy, I have started all over again and have a good apartment with my kids you can contact him through is via email (globalatmcardhackingservice@gmail.com)or his whatsap contact (+1 301-887-5071)

ReplyDeleteGlobal ATM Hacking Service are the best professionals hacking blank card team, I got my card from them, they are trusted and reliable, I saw many people giving comments about them and i gave a try and it worked for me, I so much like their technology, they can grab bank card data which include the track 1 and track 2 with the card pin which can be used to withdraw at the ATM or swipe at stores and POS. To order, you can contact them via Email: globalatmhackingservice@gmail.com

ReplyDeleteWhatsApp:+17027487593

Hi viewers, I'm posting this Because i found lots of people having marriage problems which I also experienced. I recently found help from a man called Dr. Oselumen he did a great job that made my man fell back in love with me again after ten months of separation. I want you to know there are fake online spell Dr .s if someone out there needs help, can email this great spell caster, droselumen@gmail. com check or connect with him on WhatsApp +2348054265852. He will give you the best result.

ReplyDeleteCONTACT HIM FOR ANY KIND OF HELP,MONEY SPELL,LOTTERY SPELL,PREGNANCY SPELL,DIVORCE SPELL,SPELL TO STOP COURT CASE AND WIN ANY COURT PROBLEM,DEATH SPELL,BUSINESS SPELL,HEALING SPELL,SPELL TO REMOVE BLACK MAGIC OUT FROM YOUR LIFE,FAMILY AND MARRIAGE PROBLEM.